Dividend Income – May 2023

The month of May was my biggest month in dividends so far. Nearly double what I received in April. My portfolio reached a new milestone too this month.

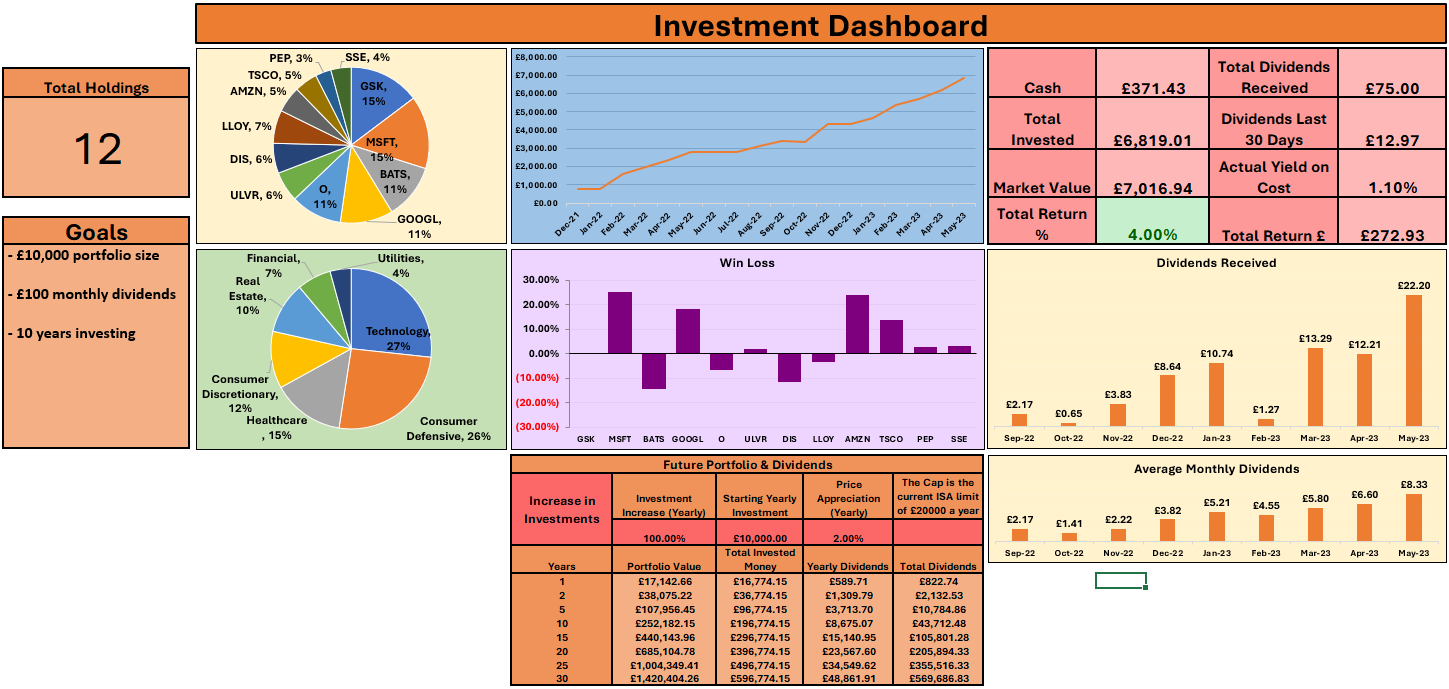

Hi, welcome to excel dividends! My name is George, I’m a financial analyst and qualified accountant from the UK, I’ve been investing since December 2021 and my portfolio is sitting at just over £7,000. And in this video I’m going to show you the dividend income I received in May 2023.

This video is to give myself accountability, and hopefully it will inspire someone like you, to start thinking about investing. If you like what you see in the video, give the video a thumbs up and check out the link in the description to get the spreadsheet for yourself.

So I received £9.23 from British American Tobacco on the 3rd of May. BAT has dropped 24% YTD and has dropped 25 and a half % in the last 6 months. It has dropped down to pre pandemic levels. I bought this stock thinking it was a fair price but has been hit with tax rises on tobacco in the UK and the stock price has since been struggling. I will be holding onto this stock as I believe investor sentiment will return.

The next dividend was from Realty Income on the 15th. This is a monthly dividend payer, so we will be seeing this every month. Realty Income is an American real estate investment trust, that invests in commercial real estate and has tenants such as B&Q and Tesco here in the UK and some other big names in the U.S. They paid me £1.95 this month.

My 3rd and final dividend I received was from Lloyds Banking Group, and they paid me £11.02. This is the biggest dividend I’ve received so far. Which narrowly beat out the GSK dividend of £10.31 I received last month. Lloyds is a commercial bank here in the UK. I believe this stock is undervalued, but the UK isn’t known for its stock price returns. Banking stocks had a bit of a run up at the end of last year and start of this year, but has since seen a correction. I believe that this is just investor sentiment and Lloyds will be a strong value creator going forward.

My total dividends received for the month of May was £22.20. This is nearly double the dividends I received in April. As you can see from the graph in the video, my dividends have been growing every month, and the monthly average is slowly creeping up.

My goals for the portfolio are split into short, medium and long term. My short term goal is to grow the portfolio to £10,000, which I will hopefully hit this year. The medium term goal is to get my dividends to be £100 a month on average, I believe I will need roughly a £30,000 portfolio to hit this. I hope this goal is about 18 months to 2 years away. And the longer term goal is to be investing for 10 years. These goals will change over time as I hit them, and they will need to be updated to be more relevant.