Is now the time to buy GSK stock?

GSK stock analysis

GlaxoSmithKline, known as GSK, stock ticker GSK is a global pharmaceutical company headquartered in the UK. It operates in various segments, including Pharmaceuticals, Vaccines, and Consumer Healthcare. The stock has been on a downward trend since the start of April 2023, and in the video above, I’m going to do an analysis of the stock, using the balance sheet, cash flows, their dividend stats and an overview of their segment in the market. Let’s get into it the GSK stock analysis.

GSK hasn’t performed too well in recent months and if we look back on the past years performance we can see the price dropped in August 2022 after concerns regarding a legal battle in the US over a drug called Zantac. Although many of the relating lawsuits have been dismissed in court, the stock price has not recovered fully yet.

I would like to note that GSK had a spin off from Haleon in July 2022 which gave them a needed cash boost of £7 Billion, this injection of capital will be used to fund new drug developments and possible acquisitions in the future. This has already been seen with a company called BELLUS. A Canada based late-stage biopharmaceutical company, focused on therapeutics for refractory chronic cough (RCC), for a cost of around $2 Billion.

Now taking a quick look at the balance sheet, we can see here that their payables which will be money owed to their suppliers has gone down from 16.2 billion to 14.2 billion and other current liabilities has decreased from 1.2 billion to 962 million, meaning that they must have paid off some of this over the last quarter. If we look back at the first quarters of last year, we can see that they have reduced their debt, a lot of this was taken on by Haleon in the merger in July 2022

Then taking a look at the cash flows, we can see it has reduced this quarter, it has gone negative, from 1.1 billion in free cash flow at the end of 2022 to negative 476 million, this looks as though its mainly due to them reducing their payables that we have just seen. Overall, the cash flows look healthy. I’d expect this to be positive in the next quarter. The next earnings report will be next month in July.

The dividend yield for GSK is 5.27%, if we look at the dividend growth stats, over the last 3 years the dividend has decreased by 8.6%, 5 years down 3.8% and 10 years down 0.7%, these stats don’t exactly look great, and if we look back at the stock price, we can see it hasn’t really moved in the last 10 years. GSK is a reliable payer, it has been paying dividends since 1988 so that’s 35 years of consecutive dividends, but it has been cut down and adjusted over the years. GSK do pay dividends quarterly and the next payout is the 13th of July.

GSK is a company that has a lot of legal battles on going all the time, most are small, but some are so big that the expected payout if they lose in court could be in the tens or hundreds of millions of pounds. This is something to keep an eye on when looking to buy into this company as it can greatly affect the stock price. It’s also a bit scary when you hold the company knowing that a huge lawsuit could come at any time and tank the stock price. Even in recent weeks they settled a lawsuit out of court which resulted in the stock going up 5% in a day.

Along with the poor stock price performance and poor dividend growth another reason not to buy is the cyclic nature of the pharmaceutical industry in general, the stock price does fluctuate depending on whether they have recently released a good product, and it can take a few years for the products to reach the point where they make money. But if you can catch the stock at a low point, it can set you up for the next few years. Whenever I think about buying a stock, I always like to take a few weeks and review, then decide.

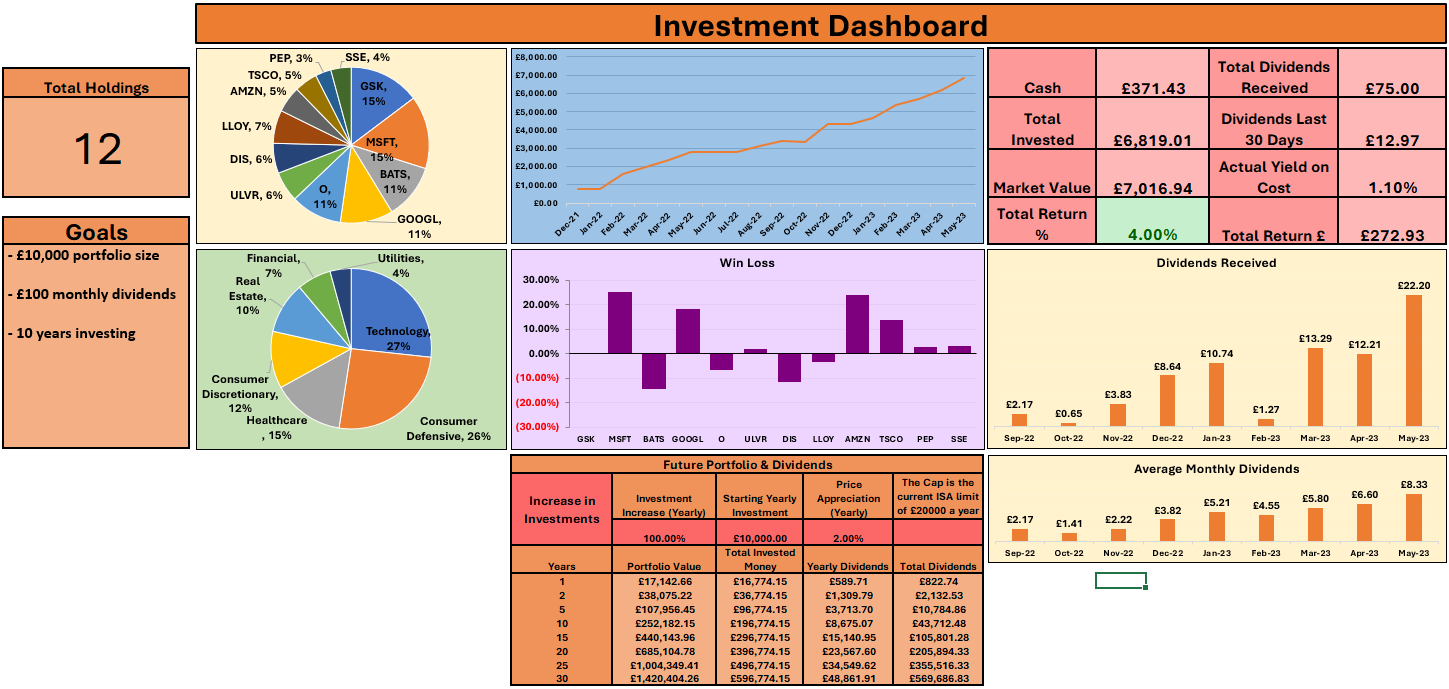

All in all, I like GSK as a stock that pays reliable dividends, if you can overcome the fear of selling when the price drops and do your research around the ongoing lawsuits, then you should make reliable passive income. It is a big holding in my portfolio, and if it wasn’t such a big part of the portfolio I would add more at these prices. Let me know what you think of this GSK stock analysis.

Check out the shop to get the latest spreadsheets for tracking your stock portfolio and dividends. Also check out the YouTube channel for more content like this and my investment journey!