Net Worth Update May 2023

Hi, welcome to the first excel dividends YouTube video! My name is George, and in this video I share with you my Net Worth Update May 2023, I talk you through how it works and some of my expenses while the video shows me inputting the data for May 2023, I’m simply adding my expenses from my bank statement into the correct column, I show you how effective this has been over the last year and tell you how it has affected my life. This video is to give myself accountability on my spending. Hopefully, it will inspire someone like you, to start thinking about your spending habits. If you like what you see in the video, then please check out the products on the website to get the spreadsheet for yourself and check out the other videos I have on my YouTube channel.

I started tracking my monthly spending in September 21. You can see on the table in the video, my spending on food and eating out was quite high at the time, I did a bit of gambling, and I spent a lot on tech, clothes, and gaming. You will also notice that I did not have any investment fees at the time, that’s because I hadn’t started investing either. I had a bit of savings, but when we look at my net worth you will see that most of it was in a standard savings account.

Looking at the graph shown on the expenses tab, you can see that I have struggled to keep my spending down this year. I’ve had a few big payments this year which really have hindered my goals for savings. I bought a PS5, which I have since sold. My car was written off in July. Using my last cash reserves and a loan from my brother, I went and bought a new car. My biggest mistake this year was overspending on this, but, I’m so glad I didn’t get a car loan, as that would have been far worse. Then, I went to Thailand for a month, which was an amazing experience which I don’t regret at all. So this year, really hasn’t been the best for savings. But that’s not to say it wasn’t a successful year for changing my view of money. Over the year I’ve reduced my spend on eating out. I’ve become less interested in the latest phone. And I’m only interested in buying quality items of clothing that will last me a long time.

The spreadsheet has a budgeting portion on it. I simply enter my monthly income. Adjust the fixed costs and enter the savings goal. This will give me my available expenses, which is my monthly budget. Below this is the expenses split for this month This shows the 50 30 20 split, which is the given split for people just starting to track their spending and budgeting. Compared to my own split, this can be adjusted for your own needs wants and goals. Therefore, it is a good way to see if you are over spending of things that you want rather than what you need. And gives you a good idea every month if you are hitting your goals.

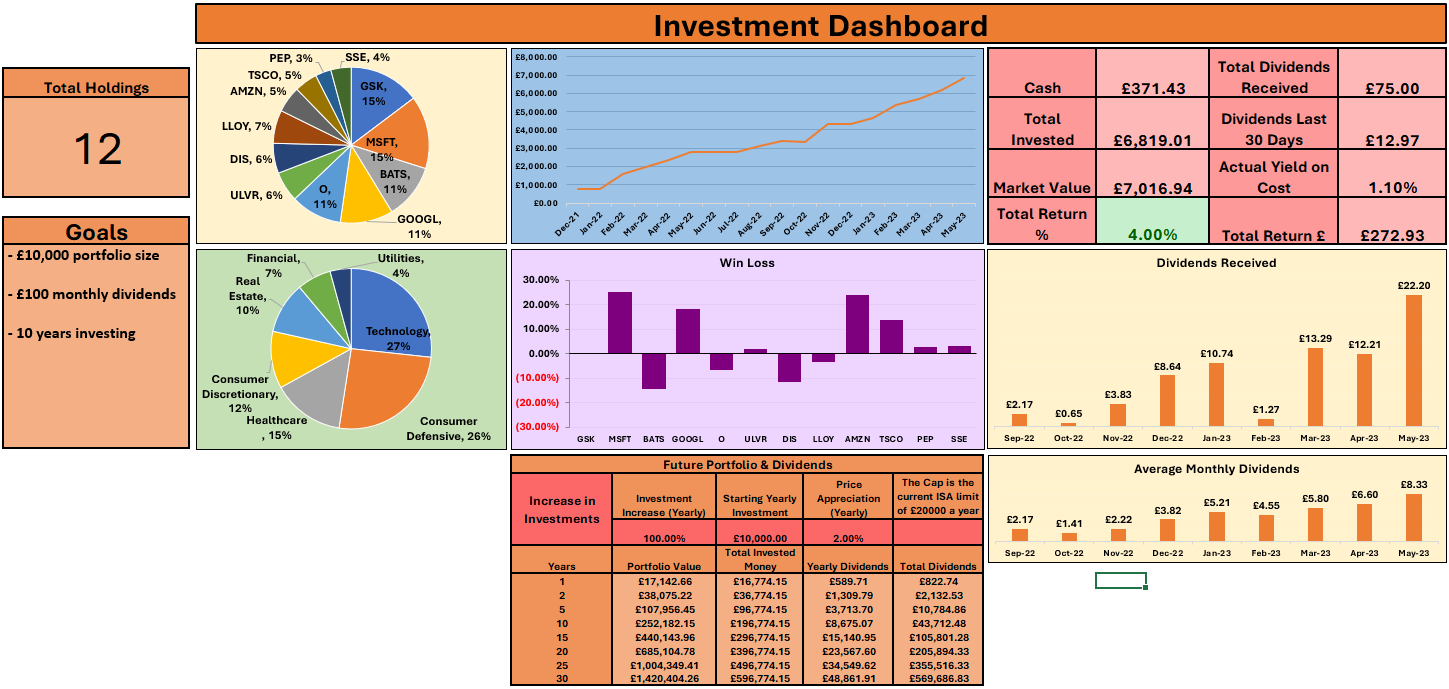

What the table doesn’t show is my investing every month. Since December 2021 I’ve been investing spare cash into the stock market which has now reached over £7000. I will do a separate video on my investing and savings. My goal is for this to reach £10000 by the end of the year.

On the balance sheet tab this shows my net worth. I have a table that is split by my bank accounts, savings accounts and investments. I take the balance at the end of the month for those accounts and add them up at the end. This will give me my net worth. You can see that over the last 12 months, my net worth looks quite flat, but it has been recovering since the start of this year. The sheet also allows you track loans that you need to pay back. This is good for knowing the balance so that you can plan ahead. My net worth is right around £15000.

Let me know your thoughts on the Net Worth Update May 2023 video down below. I’m looking for some criticism so that I can improve the content I put out. Please check out my YouTube channel. Check out the spreadsheet for yourself here.